L’ensemble des références de cet article concernent le droit suisse, et toujours l’ordonnance sur les fonds propres (OFR), sauf quand il en est indiqué autrement.

En 2018, la l’Autorité fédérale de surveillance des marchés financiers FINMA (en Confédération Helvétique, le régulateur est unique pour le secteur financier et bancaire, contrairement au modèle Twin Tower européen) avait déclaré mettre en place un régime plus favorable pour les banques non systémiques au sens de la Loi sur les banques (et seulement les banques et maison de titres, de l’article 1a LB). En 2020, après 2 ans de test et surtout l’introduction de deux nouvelles normes très contraignantes (la loi sur les services financiers LSFin et la loi sur les établissements financiers LEFin) , le régime des petites banques est définitivement mis en place grâce à la mise à jour des circulaires FINMA au 1er janvier 2020. Les petites banques particulièrement liquides et bien capitalisées sont libérées de certaines prescriptions prudentielles.

Cette augmentation de la réglementation, bien loin de protéger le client et servir efficacement le marché, semble dans les faits très dommageable pour la lisibilité et la qualité du droit. La régime des petites banques ne fait que relaxer le contrôles pour les banques non systémiques, ce qui n’est finalement qu’un retour partiel sur l’augmentation des normes de contrôle, souvent inutiles. La FINMA essaye de présenter le projet comme une façon de diminuer les coûts des entreprise. Je pense qu’il s’agit en effet du but initial, mais que dans les faits, cette diminution sera minimale.

Mais en quoi consiste ce régime des « petites banques » en droit suisse?

Le régime des petites banques

Le régime des petites banques « a pour but de rendre la réglementation et la surveillance plus efficientes pour les petits établissements particulièrement liquides et bien capitalisés » (définition FINMA).

Par rapport au régime générale des banques, les banques et établissement financiers bénéficiant de ce régime dérogatoire sont exemptés de certaines prescriptions prudentielles au vu de leur ratios financiers particulièrement favorables. Les banques y participent sont mieux capitalisées que la moyenne et disposer de liquidités élevées. En contrepartie, elles peuvent bénéficier d’un régime réglementaire moins complexe au niveau de l’ordonnance sur les fonds propres (OFR 952.03) , leur permettant par exemple de renoncer au calcul des actifs pondérés en fonction des risques. S’y adjoignent divers autres allègements qualitatifs suite à l’actualisation de certaines circulaires de la FINMA.

Ce régime s’ajoute au déjà préexistant régime « adapté » de l’article 17, qui permettait déjà des accords de principe privés avec la FINMA (des sortes de private ruling), surtout en matière d’audit, qui réduisaient déjà la voilure des contrôles .

1.1 – Critères d’entrée

Les critères d’entrée du régime des petites banques ainsi que les assouplissements prévus dans le domaine des exigences en matière de fonds propres sont réglés dans l’ordonnance sur les fonds propres (OFR), et plus précisément dans le chapitre Chapitre 1a « Application simplifiée pour les banques particulièrement liquides et bien capitalisées des catégories 4 et 5″ . Ces dispositions sont à comprendre en conjonction avec les dispositions de la Loi Bancaire, surtout pour ce qui regarde l’audit externe, et l’ordonnance sur les liquidités, pour voir comment ces standards se distinguent du droit commun.

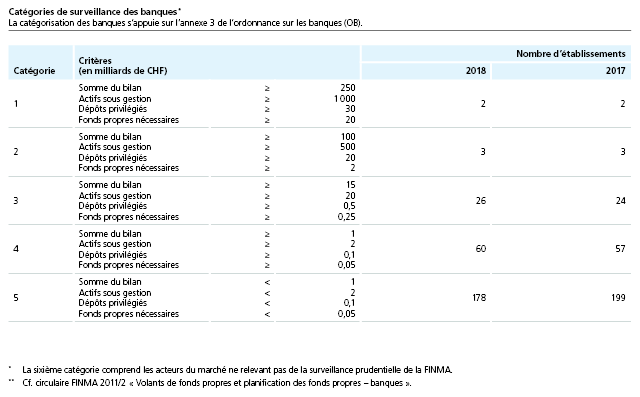

Avant tout, le régime ne s’applique, comme le dit le titre même du régime , qu’aux banques de catégories 4 et 5, en faisant référence aux règlements de Bâle et à l’annexe 3 de l’Ordonnance bancaire (OB). Il s’agit de petits instituts : les catégories 4 et 5 couvrent des banques avec moins de 15 milliards de CHF sur le bilan total, 20 milliard d’actifs sous gestion, 500M d’actifs privilégiés et 50M de fonds propres minimaux. Si les sommes peuvent sembler énormes pour nous, commun des mortels, il s’agit en grande partie d’encours.

Les critères de l’article 47b-1 doivent être remplis pour qu’une banque ou une maison de titres gérant des comptes (que ce soit au niveau du groupe ou à chaque établissement) puisse profiter de l’exemption, et ces critères sont :

- Ratio de levier simplifié d’au moins 8% (47b-2)

- Taux de liquidité moyen [LCR à 12 mois] d’au moins 110% (47b-3)

- Taux de refinancement d’au moins 100% (47b-4)

La FINMA peut en outre rejeter la demande de simplifications dans plusieurs cas, énoncés à l’article 47c:

- si une lettre de notification d’infraction a été envoyée ( art.47 c-b OFR première partie, » une procédure selon l’art. 30 de la loi du 22 juin 2007 sur la surveillance des marchés financiers (LFINMA) » – renvoi à l’article 30 de la LFINMA » Si des indices donnent à penser que le droit de la surveillance a été enfreint et que la FINMA ouvre une procédure, elle en avise les parties. « )

- ou plus généralement, des procédures ont été engagées contre établissement dans les domaines suivants: ( art.47 c-b deuxième partie OFR » si la banque n’a pas mis en oeuvre de mesures de rétablissement de l’ordre légal selon l’art. 31 LFINMA dans les domaines suivants: » – renvoi à l’article 31 de la LFINMA « Lorsqu’un assujetti enfreint la présente loi ou une des lois sur les marchés financiers, ou si d’autres irrégularités sont constatées, la FINMA veille au rétablissement de l’ordre légal. ») dans les domaines listés au points 1 à 4 de l’article 47c-b :

La FINMA peut aussi rejeter la demande si un établissement présente une gestion des risques de taux insuffisante ou un risque de taux disproportionnellement élevé, selon le modèle présenté (art. 47c-c).

Comme on peut le constater, le régime est particulièrement contraignant. Comme tout le droit bancaire et financier, la latitude du régulateur est totale. Ceci dit, le remplacement effectif des régulations

1.2 Substitution de réglementation

L’intérêt du régime dérogatoire des petites banques doit bien évidemment se comprendre dans la structure particulière du droit suisse, c’est à dire l’existence de seulement 2 (ou 3, selon les doctrines) catégories d’institutions opérant dans le domaine bancaire et financier ; et c’est à dire les sociétés dont l’activité est fondée sur l’autorisation de la Loi bancaire (LB article 1a et 1b), et les sociétés dont l’activité est fondée sur la Loi sur l’infrastructure des marchés financiers (LIMF 958.1). En droit suisse, contrairement au droit américain et européen, il n’existe pas de structures intermédiaires (sauf, justement, selon certains, le cas particulier des autorisation 1b loi bancaire et quelques exceptions mineures), qui disposent d’une moindre réglementation en matière de surveillance, contre une moindre capacité d’action. L’intérêt est bien sur de répondre à la concurrence internationale en permettant à des petits opérateurs non systémiques de diminuer leur coûts de fonctionnement (et donc, de revient).

Pour ce faire l’article 47a précise que : « Les banques des catégories 4 et 5 selon l’annexe 3 de l’OB1 peuvent demander à la FINMA de les dispenser du respect des dispositions des art. 41 à 46 concernant les fonds propres nécessaires. »

Cette dispense n’est pas forcément très indicative de la substitution de législation qui se fait, puisque les dispositions visées par l’article 47a sont complémentaires à l’ensemble à d’autres dispositions de fonds propres, et le régime alternatif des petites banques va plutôt compléter ces autres obligations déjà existantes, plutôt que remplacer les règles dispensés.

2.1 Allègements effectifs

Les établissements participant au régime des petites banques doivent respecter des exigences simplifiées pour le calcul des fonds propres nécessaires et des liquidités ainsi que des prescriptions qualitatives allégées dans les circulaires de la FINMA. Selon la FINMA même , les allègements effectifs sont:

- Suppression des exigences sur la qualité et la quantité des fonds propres nécessaires, ainsi que suppression du calcul des actifs pondérés en fonction des risques (risk weighted assets [RWA]), du volant de fonds propres et du volant anticyclique sectoriel (AZP)

- Renonciation au calcul et au respect du NSFR (liquidité)

- Allègements qualitatifs dans les circulaires de la FINMA

- Suppression des prescriptions spécifiques concernant le traitement des données électroniques de clients

- Obligations réduites de publication

- Exigences réduites concernant les tâches de contrôle du risque

- Cadence réduite de l’évaluation complète des risques par la révision interne

- Suppression des prescriptions spécifiques dans le domaine de l’externalisation

La FINMA déclare révisées ad hoc les circulaires 18/3 «Outsourcing – banques et assureurs», 08/21 «Risques opérationnels – banques», 17/1 «Gouvernance d’entreprise – banques», 16/1 «Publication – banques», 19/1 «Répartition des risques – banques», 17/7 «Risques de crédit – banques», 11/2 «Volant de fonds propres et planification des fonds propres – banques» et 15/2 «Risque de liquidité – banques». (source site FINMA) Si en théorie ces allègements normatifs devraient « permettre aux établissements participant au régime des petites banques de réaliser directement et indirectement des économies », on se demande dans les faits si ces allègements portent une diminution des coûts liés.

2.2 Un audit fondamentalement peu différent

Une des spécificités (à mon avis très positives de tout point de vue) du droit suisse est la révision obligatoire par un réviseur externe (l’équivalent d’un commissaire aux comptes français ou un commercialista italien) pour l’essentiel des sociétés enregistrées, si bien par exemple que le nom ou la raison sociale du réviseur doit être inscrite dans les statuts de la société (Code des obligations 626E-6). A titre de contre exemple, l’existence d’un contrôle externe ne devient obligatoire en droit général des sociétés français que au dessus 4 M d’euros (Décret français n° 2019-514 du 24 mai 2019 ). Ce contrôle se confond par ailleurs avec le contrôle prudentiel – et c’est là une autre particularité du droit suisse – puisque les réviseurs sont également responsables du contrôle et de l’audit des sociétés bancaires (article 18 Loi sur les Banques – et surtout la circulaire 13/3 FINMA), la FINMA intervenant seulement « occasionnellement », au sens de l’article 23 loi bancaire.

Si la praxis est évidemment différente de la lettre du droit, cette révision par un agent externe puis par l’agent régulateur structure la modalité de révision, qui se doit d’être automatisée et standardisée au maximum, et surtout, informatisée. Le réviseur fait donc un contrôle déjà sur l’ensemble des actifs, en tirant ensuite les conclusions et validant la compliance avec les différents ratios financiers demandés. En modifiant les ratios demandés, mais non pas la modalité de révision en soit, on peut se demander les réelles économies que les petites banques font effectuer. Après tout, il s’agit de changer deux lignes de codes dans des bases de données bien balisées. Ces banques bien capitalisées, pour maintenir ce statut elles ne pourront investir l’argent qui leur sert de fond de réserve.

Un communiqué récent FINMA nous informe que 64 banques, sur les 256 que comptent les catégories 4 et 5, ont adhéré à ce nouveau système, une minorité- Le régime des petites banques se présente donc plus un marché de niche, pour des banques ayant des clientèles spécifiques, qu’un régime applicable à l’ensemble des catégories inférieures. On sait que tant la réglementation des marchés financiers, que la surveillance de la FINMA axée sur le risque, sont conçues de manière proportionnée. Cela signifie que la réglementation et la surveillance tiennent compte des différences de taille, de modèles d’affaires et de risques entre les établissements. L’article 17, du régime adapté, donnait déjà cette possibilité. D’un point de vue pratique et de lisibilité du droit, cette évolution me semble donc dommageable.